Unlocking the Advantages of Employing a Loss Assessor for Your Insurance Coverage Claim Assessment

When faced with the complexities of filing an insurance claim, the decision to enlist the solutions of a loss assessor can substantially affect the result of your evaluation. By employing their knowledge, you not only expedite the case negotiation procedure but also relieve the tension and hassle normally associated with insurance cases.

Expertise in Insurance Coverage

With a deep understanding of insurance coverage, a loss assessor can navigate the complexities of insurance coverage terms to maximize your insurance coverage claim. Loss assessors serve as advocates for insurance policy holders, leveraging their knowledge to interpret the small print of insurance policy agreements. By thoroughly analyzing your plan, a loss assessor can identify the degree of insurance coverage available for your specific situation, ensuring that you obtain the payment you are qualified to.

Furthermore, loss assessors stay updated on the current changes in insurance legislations and regulations, allowing them to offer educated guidance throughout the cases process. Their experience with industry-specific terms and methods furnishes them to efficiently communicate with insurance coverage business in your place, speeding up the resolution of your case. This degree of proficiency in insurance plan establishes loss assessors apart, allowing them to recognize potential voids in coverage, analyze the value of your case properly, and work out with insurance firms masterfully to attain the finest possible outcome for you.

Accurate Claim Analysis

Having actually developed a robust structure in analyzing insurance plan, a loss assessor's next crucial job involves conducting a precise analysis of the insurance policy case. This process is important in guaranteeing that the insurance holder receives reasonable compensation for their losses. Exact insurance claim analysis needs precise interest to information, complete investigation, and a detailed understanding of the complexities of the insurance coverage.

A loss assessor will examine the degree of the damage or loss sustained by the insurance holder, thinking about numerous elements such as the terms and problems of the insurance policy, the value of the residential or commercial property or possessions impacted, and any kind of additional costs that may have emerged as an outcome of the case. By carrying out a specific analysis, the loss assessor can determine the ideal amount that the insurance provider need to pay to the insurance holder.

Moreover, a precise insurance claim analysis can aid accelerate the cases procedure and prevent disagreements in between the insurance holder and the insurance company. By engaging a loss assessor with expertise in precise claim assessment, insurance holders can navigate the insurance claims procedure with self-confidence and guarantee a fair and timely resolution.

Negotiation and Campaigning For Abilities

When participating in arrangements, a skilled loss assessor can utilize their proficiency to navigate intricate insurance claim procedures, examine problems precisely, and provide an engaging case to the insurance provider. By supporting for the policyholder's benefits, an experienced loss assessor can aid ensure that the insurance coverage company provides fair settlement that lines up with the plan terms and the actual losses incurred.

In addition, solid settlement skills enable a loss assessor to attend to any conflicts or inconsistencies that may develop during the claim evaluation process successfully. Via strategic campaigning Discover More for and settlement, a competent loss assessor can aid policyholders protect the payment they truly deserve, offering comfort and monetary relief in difficult times.

Faster Claim Settlements

An effective loss assessor helps with expedited insurance claim settlements via structured procedures and positive communication with insurance policy business. By leveraging their expertise in navigating the intricacies of insurance plan and insurance claims treatments, loss assessors can help accelerate the negotiation process for policyholders.

Loss assessors are fluent in the documents required for insurance claims and can make sure that all essential details is immediately sent to the insurance provider. Technical Assessing. This positive strategy reduces delays and quickens the evaluation of the claim, resulting in faster negotiations

In addition, loss assessors have a deep understanding of the appraisal of losses and problems, enabling them to accurately evaluate the level of the claim and work out with the insurance coverage firm in behalf of the policyholder. Their ability to provide a well-supported and comprehensive case can dramatically quicken the negotiation process.

Minimized Anxiety and Headache

Dealing with insurance claims can be frustrating, specifically when faced with the ins and outs of policy phrasings, documents demands, and negotiations with insurance firms. By getting the solutions of a loss assessor, individuals can offload the burden of managing the insurance claim process, enabling them to focus on various other priorities without the added stress and anxiety of dealing with insurance firms directly.

Moreover, loss assessors have the competence to assess the complete level of the loss properly, making certain that policyholders receive appropriate and fair settlement for their claims. This expertise can aid streamline the claims procedure, reducing hold-ups and lessening the back-and-forth typically associated with claim negotiations. Inevitably, by hiring a loss assessor, individuals can experience a smoother and less demanding insurance case procedure, allowing them to navigate tough circumstances with self-confidence and tranquility of mind.

Verdict

To conclude, hiring a have a peek at this website loss assessor for insurance case assessment can supply useful knowledge in insurance plan, exact assessment of insurance claims, negotiation and advocacy skills, faster case negotiations, and lowered stress and inconvenience for insurance holders. Insurance Assessment Australia. Their specialist guidance can make certain a prompt and fair resolution of insurance cases, eventually profiting both the insured event and the insurance policy business

By employing their expertise, you not only expedite the claim settlement procedure but likewise ease the stress and anxiety and inconvenience typically linked with insurance claims.

Neve Campbell Then & Now!

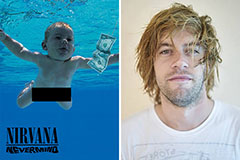

Neve Campbell Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!